When cash flow is tight, your jewelry could be your best solution. With your jewelry as collateral for a loan, you can secure immediate funding with your jewelry, allowing you to get the funds you need instantly. Maybe you have some valuable pieces tucked away in a jewelry box for safekeeping. Instead, store them safely inside a high-security vault while you enjoy a cash infusion.

Why Choose a Collateral Loan?

Collateral loans have a clear advantage when it comes to increasing your cash flow quickly, especially when compared to other loan options such as personal loans, small business loans, and home equity loans. Here are some of the reasons you might want to consider a collateral loan:

- Secure immediate funding with your jewelry at Qollateral, where you receive payment the same day via cash or bank wire transfer.

- There’s no credit check involved.

- It’s confidential.

- You may be able to secure a higher loan with collateral financing.

- It’s much easier—at least at Qollateral. Our process is fast, simple, and seamless.

How to Use Jewelry for a Collateral Loan

At Qollateral, the process couldn’t be any easier. You make an appointment, come to our highly secure New York City office with your jewelry, and one of our team members will give you an instant estimate, all while making sure you feel comfortable and cared for. All visits are completely confidential and discreet.

There are zero hoops to jump through, just one short, simple contract to sign protecting both parties. We provide same-day payments via cash or bank wire transfer. If you’re unsure, that’s fine too. There is never any pressure. We work for you.

What Happens to My Jewelry While It’s Held?

We fully insure and securely store your jewelry in one of our state-of-the-art vaults until you repay the loan. Our offices are located in the highest security building in New York City, the International Gem Tower, so you can feel confident that your pieces are even more secure than if they were in your possession. We understand that jewelry is not only valuable, but also sentimental and sometimes irreplaceable. It is a comfort to know that your treasured pieces are most often safer with us than they are at home.

What Types of Jewelry Can I Use as Collateral?

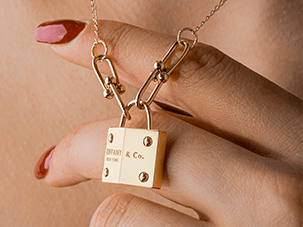

Qollateral accepts high-end jewelry brands, including but not limited to Cartier, Tiffany & Co., Van Cleef & Arpels, Harry Winston, and Bulgari. We also accept unbranded jewelry. All forms of jewelry, from necklaces, bracelets, and earrings to engagement rings and wedding bands, are acceptable. We accept diamonds of all cuts and sizes. Our team members have extensive experience handling and appraising luxury jewelry. Your heirloom pieces will be treasured and cared for as if they were our own.

Are There Any Disadvantages to Collateral Lending?

The only disadvantage or risk involved is that if you do not pay back your loan, you risk having to walk away from your asset. It’s important to remember that no matter what kind of loans you choose, there will be some kind of risk if the loan is not repaid. However, in the case of using your jewelry as collateral, you want to be confident beyond a reasonable doubt that you will be able to repay the loan.

We hope this helps you decide if using your jewelry to secure a collateral loan is the right solution for you. We invite you to reach out below if you have any questions or if you’d like to get started.

Looking to sell your Jewelry? Read this step by step guide on how to sell today!