By Michael Manashirov, COO of Qollateral

Published February, 2026 | 6-Minute Read

LVMH Watch Week is an annual industry event held each January, where brands under the mega-luxury conglomerate, such as Hublot, Tag Heuer, Zenith, and others, unveil their latest offerings. It’s an important show because watches like limited editions, brand-new models, and more can give us clues as to what to expect from the brands throughout the rest of the year. They also affect lending and the secondary market.

What 2026 LVMH Releases Mean for Watch Owners and Borrowers

- New releases often increase demand for existing collections.

- Higher demand improves liquidity in the secondary market.

- Improved liquidity supports stronger watch-backed loan offers.

- In a stabilizing market, borrowing against watches can be more strategic than selling.

One factor to consider is how new watch releases can affect the resale values of established collections. New launches draw attention to an entire collection, which can increase interest in older and current models. At the same time, highly anticipated launches with limited inventory or long waitlists can see significant price spikes. For example, Zenith and Tag Heuer added to the Skyline and Carrera collections at this year’s LVMH Watch Week, placing each directly in the collector spotlight. When collections receive renewed attention, demand often increases across both the primary and pre-owned markets, supporting price stability and liquidity.

It might be too early in the year just yet, but discontinued watches can also come into play in regard to resale values. Models dropped by brands following LVMH don’t just disappear. What we’ve seen is that they can sometimes become more relevant in watch collecting circles, especially for particularly popular models or those with discontinued movements, etc.

Understanding how new releases shape resale values can help watch owners decide whether to sell, hold, or borrow against their assets [LINK: https://qollateral.com/watch-loans/ ], especially when market conditions are shifting.

Key Takeaways

- Tag Heuer and Zenith expanded collections with new Carrera and Defy Skyline releases, while Hublot introduced the Big Bang Original Unico.

- The recent LVMH market correction following the COVID-19 boom has strengthened demand for watch-backed lending. Borrowers are opting to loan against watches as the market continues to stabilize rather than sell them.

- Following watch release cycles can help borrowers time loans more strategically and maximize loan offers.

2026 LVMH Watch Releases

Here’s a quick recap of the most talked-about releases at this year’s LVMH watch show:

Tag Heuer: For LVMH, the brand focused on the Carrera, releasing three chronographs. The Carrera Split-Seconds Chronograph is the first model in the series to feature a rattrapante complication. The Carrera Seafarer with tide indicator is inspired by vintage Seafarer and Solunar tide watches. Lastly, the Carrera Chronograph Glassbox debuted in a new 41mm size.

Hublot: A brand-new collection just hit the market, the Hublot Big Bang Original Unico, which combines the aesthetics of the original Big Bang model with the brand’s Unico movement. Hublot also added some new colors to the mix, including sage green for the Classic Fusion and coal blue for the Big Bang and Spirit of Big Bang.

Zenith: The Defy Skyline took the market by storm in 2022. For LVMH, the brand is strengthening the collection with several new watches, from eye-catching skeleton movements to a new silver-dial variation of the Skyline 36.

What brands are under LVMH?

How the New 2026 LVMH Releases Affect Older Models

Only time will tell for sure how the new LVMH releases will affect the secondary market, but we can already see some potential patterns. Tag Heuer, Hublot, and Zenith all chose to support existing collections. When brands reinforce existing collections rather than replace them, resale values tend to remain stable or improve, as attention stays concentrated on well-established models. We can expect price stability as the Skyline, Carrera, Big Bang, Spirit of Big Bang, and Classic Fusion collections enjoy the spotlight. Additionally, interest in the original Big Bang might increase with the release of the newer Big Bang Original Unico.

How the New Releases Benefit Qollateral Customers

As a luxury watch lender, we keep a close eye on the secondary market because it directly affects loan values. When new releases draw attention to certain collections or discontinued models, demand for those watches on the secondary market can ramp up. If a watch is easier to resell, it can support stronger loan offers and more competitive loan-to-value ratios (LTVs). Stronger loan offers improves liquidity and may affect the timing strategy for some borrowers who choose to hold rather than sell.

Nowadays, watches are no longer viewed as just collectibles, either. Instead, they’ve become solid financial assets shaped just as much by overall design and rarity as by other factors like new watch releases, upgrades to existing collections, and even market behavior.

Market Reality Check: LVMH Shares Drop, What That Signals for Lending

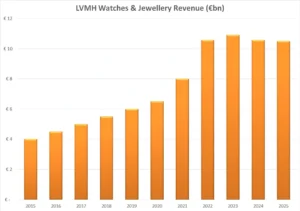

The luxury watch market was on a sharp upward trajectory following the pandemic, with its peak hitting in 2023. Since then, LVMH’s watches and jewelry division has experienced a normal market correction with prices dropping from €10.9 billion at the peak in 2023 to just over €10.4 billion at the end of 2025.

A recent report from Watchpro: also illustrates a boost near the end of 2025 for a full-year decline of just 1%. Shares fell 8% after 2025 earnings were released. Still, the brand remains hopeful that the late-year recovery in 2025 indicates demand remains high, but at more sustainable levels than during the post-COVID boom.

Graph image: WatchPro

What This Means for Borrowers in 2026

Periods of correction, such as LVMH is currently experiencing, can drive demand for asset-backed loans as watch owners choose to hold long-term assets rather than sell them in an uncertain market. That ties back to why market timing matters when securing the best loan offer. Cooling periods can be ideal windows for luxury asset-backed loans, and choosing a watch that’s in the spotlight, such as one from a collection at the center of the 2026 LVMH releases, can maximize liquidity.

Other Major Watch Shows in 2026: LVMH Watch Week vs. Watches & Wonders

When it comes to timing asset-backed loans, LVMH isn’t the only watch show to keep an eye on. LVMH only showcases its own brands during LVMH Watch Week (Hublot, Zenith, Tag Heuer, Louis Vuitton, Bvlgari, Daniel Roth, Gérald Genta, Tiffany & Co.). Watches & Wonders, on the other hand, is a non-profit organization run by Rolex, Richemont, and Patek Philippe. It takes place every spring in Geneva and features many high-end watch brands, including those under the LVMH umbrella.

The benefit of LVMH is that it takes place earlier in the year (January), allowing those brands to get a headstart on new releases before Watches & Wonders.

Final Thoughts on How New Releases Affect Watch-Backed Loans

LVMH introduces a fresh wave of watches every year, and its impact can be felt long after the show closes. We’ve hopefully illustrated here how new releases can influence how watches trade in the pre-owned market, as well as how lenders determine watch values in the months following the show. In a market where prices are stabilizing rather than surging, it’s even more important now to understand how watch release cycles work. It can lead to better timing for lending and even better liquidity for your collection.

Discuss your options with our team today. Make an appointment for a free, no-obligation watch appraisal.

- 100% Discreet

- 100% Safe

- 100% Secure

- 100% Risk-free

- 100% Insured

- 100% Satisfaction Guarantee