Written by Michael Manashirov, COO of Qollateral

Last Updated February 20, 2026 | 8-minute read

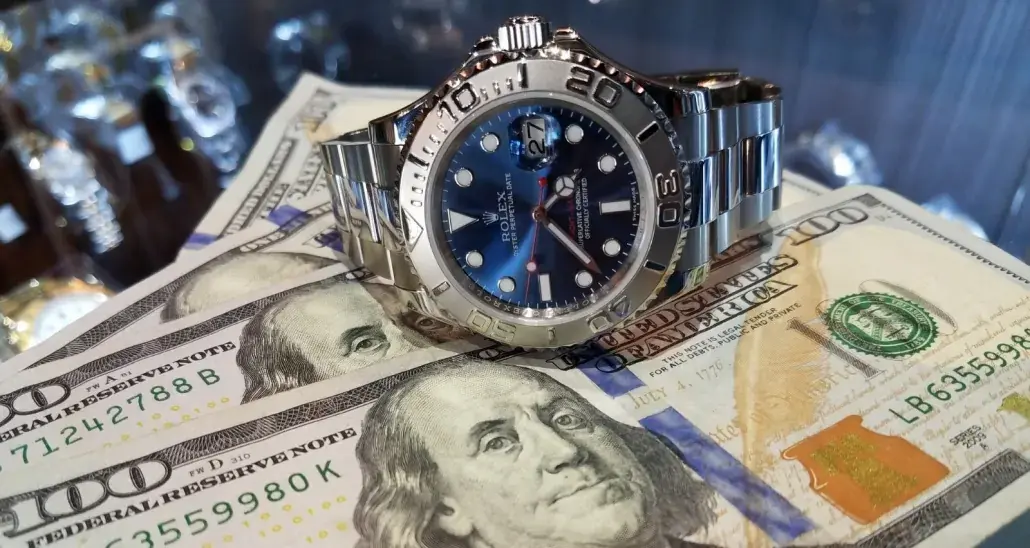

Your luxury watch represents more than craftsmanship and style. It’s a tangible financial asset that can provide immediate capital when you need it most.

At Qollateral, we’ve provided millions in luxury watch loans to collectors who recognize the financial potential in their timepieces. Brands like Rolex, Patek Philippe, Audemars Piguet, and Richard Mille command substantial lending value based on their market strength and resale demand.

The watch-backed lending market continues to expand. More people discover they can access significant funding quickly and discreetly, often with better terms than traditional banks offer. We’ve earned an A+ BBB rating through transparent valuations, exceptional security, and same-day funding.

What Makes Watches Perfect Collateral

Watches rank among our most reliable collateral assets. The reasons are straightforward.

Premium timepieces secure 60-80% of their current market value. A watch worth $100,000 could provide $60,000 to $80,000 in immediate funding. The appraisal process takes under one hour, and we complete same-day funding via cash, check, or wire transfer.

Market values for luxury watches are well-established and transparent. Unlike some assets where pricing varies widely, brands like Rolex, Patek Philippe, and Audemars Piguet maintain consistent global recognition. An appraiser in New York prices these watches similarly to one in London or Tokyo.

The secondary market for luxury watches is robust. Transaction data from auctions, authorized dealers, and gray market sellers provides clear pricing benchmarks. This transparency benefits everyone involved.

The Value Equation: What Your Watch Is Worth

Multiple factors determine how much you can borrow. Understanding these elements helps you maximize your offer.

Brand Reputation and Market Position

We categorize brands into tiers based on resale performance and market demand.

Tier 1 Brands (70-80% LTV):

- Rolex, Patek Philippe, Audemars Piguet, Richard Mille, Vacheron Constantin

- Strongest secondary market performance

- Limited production creates sustained demand

Tier 2 Brands (60-70% LTV):

- Omega, Breitling, IWC, Panerai, Cartier, Hublot

- Strong resale markets

- Excellent timepieces with good liquidity

Model Rarity and Current Demand

Not every model within a brand performs equally. A Rolex Daytona commands higher premiums than a Datejust because of scarcity and collector interest. Limited editions, discontinued references, and pieces with unique characteristics often exceed standard valuations.

Market trends influence pricing significantly. Certain models experience demand surges that boost values. We track these movements through auction results, dealer inventory, and secondary market sales to ensure accurate appraisals.

Condition Assessment

Physical condition directly affects loan offers. Excellent or very good condition receives full market consideration with minimal wear and all original parts functioning properly. Good condition results in modest adjustments for light wear, but nothing that affects functionality. Fair or poor condition requires larger reductions for damage, missing parts, or excessive wear.

Original parts matter tremendously. Aftermarket bracelets, replacement dials, or non-factory components can reduce value by 20-50%. We verify originality through serial research, factory records when available, and expert examination.

Documentation Adds Value

Complete documentation boosts offers by 10-20%:

- Original box and warranty papers

- Purchase receipts establishing provenance

- Service records from authorized dealers

- Certificates of authenticity

Missing documentation doesn’t disqualify your watch. We can verify authenticity through other means. However, complete papers maximize borrowing capacity.

Modern vs Vintage: Two Different Markets

Watch age significantly affects how we evaluate value. These categories follow different market dynamics.

Modern Watches (Post-1985):

Contemporary pieces are valued on current demand and popularity. The Rolex Submariner or Patek Philippe Nautilus trade is based on retail waitlist dynamics and secondary market premiums.

Authentication is straightforward. Serial numbers, reference codes, and manufacturing details are well-documented. Parts standardization makes verification easier. Buyers expect near-mint condition for modern pieces. Over-polishing or excessive wear reduces the value more severely than with vintage watches.

Market dynamics shift quickly. Trends can elevate certain models rapidly, then cool just as fast. We stay current on these movements.

Vintage Watches (20+ Years Old):

Heritage, rarity, and historical significance drive vintage values. A 1960s Rolex Submariner reference 5513 or Patek Philippe Calatrava commands premiums based on scarcity and collectibility.

Originality is paramount. Collectors prize untouched dials, original hands, period-correct crowns, and unpolished cases. Even small deviations from factory specifications dramatically impact value.

Provenance matters significantly. Documentary evidence of military service, celebrity ownership, or historical events adds substantial premiums. Natural aging and tropical dial discoloration often appeal more than restoration. However, damage or incorrect service parts still reduce value.

Authentication requires deeper expertise. Decades of potential modifications, service work, and parts changes create complexity. We maintain extensive reference materials and consult factory archives when necessary.

Understanding Loan-to-Value Ratios

LTV ratio determines borrowing capacity relative to your watch’s worth.

The formula is simple: (Loan Amount ÷ Watch Value) × 100 = LTV Percentage

Real-World Examples:

- $200,000 Rolex Daytona → $160,000 loan (80% LTV)

- $50,000 Patek Philippe Nautilus → $35,000-$40,000 loan (70-80% LTV)

- $30,000 Rolex Submariner → $21,000-$24,000 loan (70-80% LTV)

- $15,000 Omega Speedmaster → $9,000-$10,500 loan (60-70% LTV)

Conservative ratios protect both parties from market fluctuations. The buffer between the loan amount and the market value means we rarely require margin calls or additional collateral during your term.

Maximizing Your Offer:

- Apply when markets are strong for your model

- Gather complete documentation before your appointment

- Consider professional servicing if needed

- Combine multiple watches for larger loans

Fort Knox for Timepieces: Our Security Standards

Security isn’t negotiable. We’ve implemented multiple protection layers for your timepiece.

Our offices are inside Manhattan’s International Gem Tower, the city’s highest-security building. The facility houses the Gemological Institute of America and features 24/7 armed security with controlled access points. We maintain appointment-only access to ensure complete control over who enters our premises.

Storage happens in state-of-the-art vaults with biometric access controls and time-locked mechanisms. Climate control maintains optimal temperature and humidity for mechanical movements. Fire suppression and seismic stability engineering provide additional protection.

Lloyd’s of London insures every item at full replacement value, not just the loan amount. If your watch appraises at $100,000 and you borrow $75,000, insurance covers the full $100,000 against theft, damage, or loss.

Confidentiality is fundamental to our operation. We maintain no public transaction records. Private consultation rooms ensure discreet meetings. Unmarked packaging protects shipping clients. Many of our clients are high-profile individuals who require absolute privacy.

Professional Authentication: What We Verify

Expert examination during appraisal ensures authenticity and accurate valuation.

Serial number verification cross-references against factory records and checks for re-engraving or alterations. Every luxury watch carries unique identifiers. We confirm matches between case and movement numbers.

Weight and measurements are checked against factory specifications. Counterfeit watches often use inferior materials, affecting weight. Precise measurements become critical authentication tools. Case dimensions must match published specifications for your reference.

Original parts confirmation examines the dial for reprints or modifications. We verify that hands and luminous material are period-appropriate. Movement inspection confirms caliber authenticity and proper finishing. Bracelet and clasp authenticity are verified against factory standards.

Documentation review validates warranty cards against serial numbers. We check service records through brand networks when possible. Certificates of authenticity must come from reputable sources we recognize.

Protecting Your Watch’s Value

Actions you take directly impact your loan offer.

Maintain complete originality. Avoid aftermarket modifications of any kind. Keep all original parts, especially bracelets, which can add $1,000 to $5,000 or more, depending on the watch. Schedule regular professional servicing every 3-5 years. Store your watch properly in the original box or a dedicated watch case with proper cushioning.

Over-polishing removes metal and softens case lines, reducing value by 20-40%. Missing original bracelets require deductions based on replacement costs. Deferred maintenance shows in poor timekeeping, sticky chronograph pushers, or loose bezels. These issues suggest neglect and potentially larger problems.

Excessive wear beyond normal use raises concerns. Deep scratches, dents, or damaged crystals all reduce offers significantly.

Address functionality issues before seeking a loan. Proper maintenance maximizes value.

The Qollateral Experience: Start to Finish

Our process is designed for efficiency and transparency.

Schedule an appointment by calling or texting 212-287-5257, emailing hello@qollateral.com, or filling out our contact form. We’re located at 50 W 47th Street, Suite 319, New York, NY 10036 in Manhattan’s Diamond District. Gather all documentation, including box, papers, receipts, and service records. Know your watch’s model, year, and special features.

The appraisal takes under one hour. We complete authentication verification, condition assessment, market research, and documentation review. You receive a fair offer with a clear explanation of our methodology. There’s no pressure to accept.

Our Loan Terms:

- $2,000 to $10 million based on value

- 2.9% per month interest (34.8% APR)

- Maximum 120-day repayment period

- No credit check or personal guarantee required

- No prepayment penalties

Example: Borrow $10,000, pay approximately $290 monthly interest. The total 4-month repayment comes to approximately $11,160.

Choose same-day funding via your choice of cash, check, or wire transfer. Your watch moves to our secure vault with full insurance coverage. When you’re ready to repay, schedule a pickup appointment. We verify identity, process payment, and return your watch in the exact condition you left it.

When Watch Loans Make the Most Sense

Luxury watch loans work well for specific situations.

Short-Term Liquidity Needs:

Business cash flow gaps between receivables and payables are common. A watch loan provides bridge financing without disrupting operations or requiring lengthy bank applications. Real estate investors need quick capital for down payments or closing costs when timing is critical. Tax payments, insurance premiums, or other large scheduled expenses can strain reserves.

Preserving Your Collection:

Market volatility makes selling stocks or mutual funds disadvantageous. Watch loans provide capital while keeping investment portfolios intact. If your watch is appreciating, selling now means missing future gains. Borrowing against it provides current capital while preserving future upside potential.

Family heirlooms carry emotional value exceeding financial worth. Loans preserve these pieces for future generations while meeting current needs.

Seizing Opportunities:

Time-sensitive business opportunities sometimes require immediate capital. Watch loans can fund inventory purchases, equipment acquisitions, or expansion without traditional lending delays. Market corrections create buying opportunities across asset classes. Quick access to capital lets you capitalize without liquidating existing positions.

Personal Emergencies:

Medical expenses, family emergencies, or urgent home repairs sometimes exceed available funds. Watch loans provide quick capital without the high interest rates of credit cards or unsecured personal loans. Legal fees, unexpected tax liabilities, or other financial surprises can be managed through watch-backed financing.

Ready to Access Your Watch’s Value?

At Qollateral, we’ve built our reputation on fair valuations, exceptional security, and outstanding service. Your timepiece deserves expert handling and professional appraisal. We stay current on market trends and valuation methodologies to ensure competitive offers.

Your luxury watch holds serious financial value. Put it to work for you when you need it most. All you have to do is contact us today to get started.