Are lab-grown diamonds an ideal alternative to natural mined diamonds? The answer is not so clear-cut (pun intended). It depends on many personal factors, including what you value most and what you are hoping to get out of your diamond. We will separate fact from opinion and present you with an unbiased comparison so that you can make an informed decision as to whether or not to consider a lab-grown diamond.

Are Lab-Grown Diamonds Socially Conscious?

Many consumers believe that lab-diamonds are a more socially conscious choice. It’s true that some mined diamonds can be sourced under unethical and inhumane conditions. Blood diamonds, also known as conflict diamonds, are mined in war zones to fund war, exploiting locals to work under horrific conditions. In order to put an end to blood diamonds and establish a benchmark for ethical sourcing, the United Nations introduced the Kimberley Process in 2003. The Kimberley Process, however, only ensures that diamonds are not financing war. It does not address the human rights concerns of unethical mining conditions, and therefore, it can still be difficult to be sure that your diamond is ethically sourced.

While diamond mining labor is largely unregulated, certain luxury jewelry brands have committed to ensuring that all of their diamonds are ethically sourced, including one of our favorites, Tiffany & Co. If you’re leaning towards a natural diamond, your best bet is to find a brand that is committed to ethical sourcing and transparency. Also, we will add that for those investing in an engagement ring, a luxury diamond engagement ring from Tiffany & Co. will retain its value much better than a non-branded diamond engagement ring. If there’s room in your budget, we highly suggest going that route for both the long-term financial investment and the ethical sourcing.

Another factor to consider is that diamond mining tends to create more jobs and stimulate local economies than lab-grown diamonds. The chain of production for lab-grown diamonds is much shorter, and less labor is required. (This is also why they’re cheaper.)

So, are lab-grown diamonds really the more socially conscious choice? That answer is that it depends on the diamond.

Are Lab-Grown Diamonds More Sustainable?

This is another question that has many layers to it. Diamond mining is also unregulated in terms of sustainability, so the process is not always environmentally responsible. It can disrupt the local ecosystems by polluting the soil and water, and it is largely carried out by fossil fuels which release carbon and greenhouse gasses into the atmosphere.

At the same time, many lab-grown diamonds are not eco-friendly either. The production of lab-grown diamonds uses an intense amount of energy with large oven-like machinery running at 2,000 degrees Farenheit 24/7. In fact, Trucost (part of S&P Global) reported that the estimated carbon footprint of a polished diamond is 69% less than that of a lab-grown diamond. If you are considering a lab-grown diamond in order to reduce your carbon footprint, you’ll want to ensure that it was produced with a renewable energy source.

The same can be said for mined diamonds, as well. If you want a natural diamond that is also sustainable, your best bet is to choose a luxury jeweler that is determined to reduce their carbon footprint and is committed to environmentally responsible sourcing. Using our earlier example, Tiffany & Co. has really gone above and beyond to source ethically and sustainably mined diamonds.

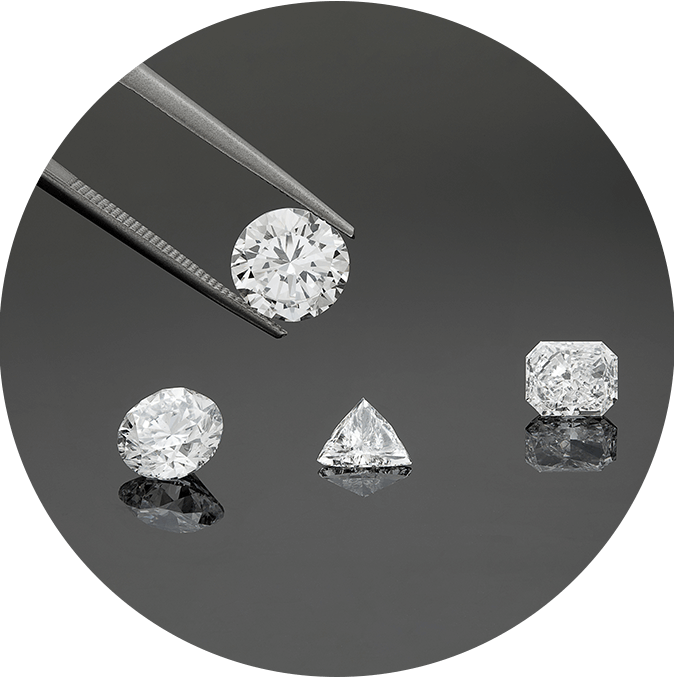

Are Mined Diamonds And Lab-Grown Diamonds The Same?

Again, yes and no. Yes, they have the same physical and chemical properties. But no, they are not the same, because it is possible to determine whether a diamond is natural or lab-grown. While the differences cannot be seen with the naked eye, natural mined diamonds have trace amounts of nitrogen, while lab-grown diamonds have no nitrogen. Lab-grown diamonds are inscribed with LG at the base.

A lab-grown diamond is considered a real diamond, not synthetic, even by the Gemological Institute of America (GIA), who by the way, are in a neighboring office to ours. Still, the two are not valued equally, partially because of the elusive, ethereal quality of a natural diamond that its lab-grown counterpart just cannot replicate, but also because of the financial aspects we explore below.

Are Natural Diamonds Or Lab-Grown Diamonds A Better Investment?

While lab-grown diamonds are cheaper to purchase, natural diamonds are by far the better investment. Natural diamonds are rare and exist in a finite supply, naturally formed over billions of years in the earth. They will therefore always be more expensive and more desirable than their lab-grown counterparts. Natural diamonds retain their value beautifully (again with the puns).

For some, the ability to purchase a larger carat diamond of quality outweighs the long-term financial investment. We see this especially with diamond engagement rings where size tends to be of the greatest importance. You probably won’t be surprised that, as a collateral loan and lending company, we would always choose long-term financial investment over a larger carat diamond. But again, that’s our view because we’ve seen how one simple diamond can afford a client instant cash that allows them to pay their child’s college tuition or keep their business afloat in tough times. Perhaps you’re not considering your diamond as a financial investment right now, but we can assure you that a natural diamond is the ultimate financial safety net.

If you would like to get an idea of what your diamond is worth, please reach out to book an appointment at Qollateral. There’s no pressure, it’s completely confidential, and by the time you’ve taken your last sip of one of our killer cappuccinos, you’ll be out the door with an estimate. If you’re looking for a same-day cash infusion by borrowing against your diamond or selling your diamond, look no further that Qollateral, NYC’s best pawn shop.

Content Disclaimer

The content provided by Qollateral, LLC is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Qollateral, LLC or any third party service provider to buy or sell any commodities, securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction. Qollateral, LLC is not an attorney, accountant or financial advisor, nor is it holding itself out to be, and the information contained on this Website is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation.

All content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. Qollateral, LLC is not a fiduciary by virtue of any person’s use of or access to the Site or any content contained therein. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on the Site before making any decisions based on such information or other content. In exchange for using the Site, you agree not to hold Qollateral, LLC, its affiliates or any third party service provider liable for any possible claim for damages arising from any decision you make based on information or other content made available to you through the Site.